- Home

- FAQ

Got questions? This way.

Explore answers to common questions about community pubs and investing.

General FAQ

Here are some answers to common general questions. If you don’t see an answer to your question, please don't hesitate to get in touch: info@crossguns.org.uk

A community pub is exactly what it sounds like - a pub that is owned and operated by the community, for the community's benefit. The concept of community pubs first emerged in the UK in 1982, and since then, there have been approximately 200 community pubs that have opened and are currently in operation.

A pledge is a way of letting us know that you support the community purchase and would, in principle, be willing to invest.

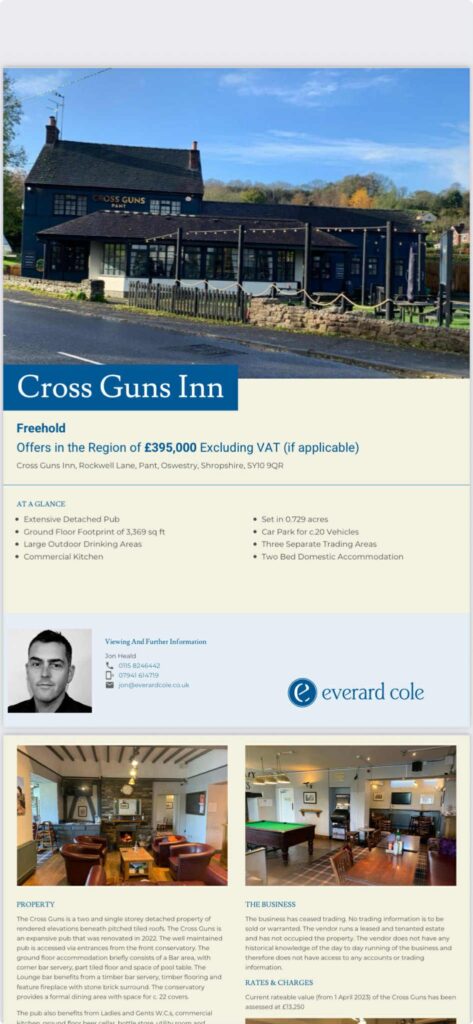

Currently, the pub is on the open market with a guide price of £395,00 plus VAT.

We are currently obtaining independent valuations to ensure the community does not overpay.

The following is a suggested guide as to the timescales we should be working towards.

There are two main reasons why a Cross Guns in community ownership could be more viable than it has been recently.

- Cost Savings: If we own the pub, we will immediately be around £24,000 better off per year as we won’t need to pay rent to a brewery. As our drinks wouldn’t be tied to the pubco, we should be able to purchase local beer and other products at a better price, too.

- Loyalty: We’d like to think that local people would be much more loyal to a pub that they own – after all, it’s in their best interests to support the venture. It is also an opportunity for the pub to adapt and offer different services to the broader community, maybe a cafe. Over the years, some local people have got out of the habit of going to their local pub. By being much more than just a pub, we hope many of these people will come back. Just as the community Cross Guns would aim to be loyal to local producers, suppliers and tradespeople, so we hope that these people would become loyal supporters and customers of our pub.

Community pubs are unique in that they are funded through a public share offering, giving community members and other third parties the chance to invest. This gives shareholders a sense of ownership and involvement in the pub's success. There are typically minimum and maximum investment thresholds in place.

Community pubs play an essential role in preserving the heart and soul of small towns and villages. Many of these beloved establishments have been at risk of closure, but have been saved by community ownership. This not only ensures the continued availability of a vital service, but also allows members to have a say in the pub's operations. From the running of the pub to the types of services offered, community ownership allows for a more tailored and personalised experience. As well as serving as a gathering place for residents, community pubs often go above and beyond by providing additional services such as a meeting place, café, or local shop. By supporting and investing in these community pubs, we can all play a part in preserving the unique character and charm of our towns and villages.

Aside from the obvious benefits of owning and running the pub by the community, for the community, there is always a risk that private investment may not be forthcoming. Over the last two decades, more than 13,000 pubs have closed in the UK, with the land typically being sold for change of use, often ending up as housing. Once local pubs close they are lost for good. It is also worth noting that out of the 217 community pubs started, 100% are still running.

Investors FAQ

Here are some answers to common investors' questions. If you don’t see an answer to your question, please don't hesitate to get in touch: info@crossguns.org.uk

Your investment helps with the purchase, ongoing upkeep, and improvements to the Gross Guns, as well as developing financial reserves. It helps ensure the pub remains a community asset in the long term.

The preservation of the Cross Guns in Pant will have a direct impact on the community's residents and friends. Not only will they have access to a valuable amenity, but the Cross Guns will also contribute to Pants' overall strength, vibrancy, and unity.

Community-run businesses have proven to be successful and sustainable ventures. supported by the fact that there are currently over 200 community pubs in the UK. This indicates that Cross Guns has the potential to thrive and become profitable. With a well-thought-out business plan, we are confident the pub has a great future.

The Friends of the Cross Guns is a dedicated group of residents who share a deep love for the Cross Guns and recognise its significance for the community. They are not financially motivated by the project but are devoting significant time to securing the purchase of the pub.

The shareholders will elect the Management Committee, which will appoint a general manager to manage the day-to-day running of the business. They will work closely with the manager to ensure that the locals' vision for the Cross Guns is delivered.

Yes, they do. Everyone has an equal voice, regardless of the size of their investment.

Based on the rules of other community pubs, you would not be allowed to withdraw your shares in the first three years. After that, you would need to give at least three months’ notice.

An Investors' Pack will be produced in due course, providing full details on how your investment will be handled.

All the business’s assets, including the freehold of the building, would be sold and the proceeds of the sale (after paying any creditors) divided between the shareholders up to the value of their shares. You might receive the full value of your shares back or you might lose part or all of your investment.

The minimum you can invest is £50 (i.e., one share at £50 each), although we hope most investors will invest considerably more than the minimum. The maximum that can be invested is £100,000, which is the legal limit for individual investments in community benefit societies.

This share offer is unregulated, as it is exempt from the Financial Services and Markets Act 2000 or subsidiary regulations, which means there is no right of complaint to the Financial Ombudsman, nor can you apply to the Financial Services Compensation Scheme.

We aim to pay a reasonable interest rate to our members; however, this will depend on the success of the business. Interest will be paid gross.